Can I Bring Gold from Africa to Canada? Find all the Answers.

Yes, it is very possible for you transport gold from Africa to Canada. What is significant is that ensure that you observe the set rules and regulations. While it is possible to take gold to Canada, a lot is involved to have it reach there.

You do not pack gold like you do it for normal trips. First, you must have deep understanding of the Canada customs and border protection measures.

Steps on How to Import Gold from Africa to Canada:

Get the right documentation.

If you are considering transporting gold from Africa to Canada, first, ensure that you have the right documentation. By securing the right documentation, means what you are transacting in is legal. Take note of the standard amount of gold you may need to carry with you.

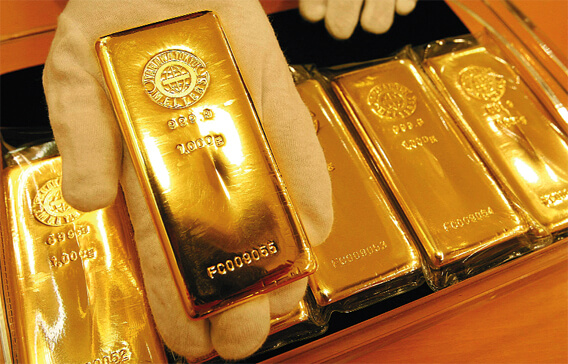

In case the total currency/financial instruments is valued over US Dollars 10,000, you might be required to report it to Canadian customs and border protection. This encompasses gold bullion and coins considering their monetary instruments.

In case you plan to travel with gold bullion/coins, usually it is advisable that you keep them in your carry-on luggage and declare them to Canadian customs and border protection on arrival. Declaring your gold means you get saved from getting issues when you get to Canada.

Foreign currency and gold coins.

Aside from observing the instructions on bringing gold to Canada, it is also important to take note of the money instructions also often referred to as negotiable monetary instruments. According to the Department of the Treasury, declaration of monetary/any foreign currency should be a must, especially if the value exceeds USD 10,000.

In case you plan to travel to Canada with both foreign currency and gold, consider declaration of your property. This is an indication that you comply with the Canadian Customs and Border Protection as well as the Department of the Treasury.

Gold Coins, bullion & medals.

It is possible to go to Canada with gold medals, bullions, coins provided that you have observed the set regulations. Declaring them to the Canadian Customs and Border Protection official on arrival should be a must-do.

Counterfeit/copies.

Like other states, importation of counterfeit gold is highly prohibited by Canadian regulations. This also applies to those not well-marked by the country of issuance.

The whole idea is aimed at avoid circulation of unauthorized/fake gold coins in the country and promotes integrity of gold imports.

Gold and duty taxes.

Gold and duty taxes should not be left out any time you think of bringing gold into Canada. The duty taxes are best understood as taxes imposed by the Canada Government on imported goods and can differ depending on the kind of gold and its value.

The best example can if you plan to travel with gold bullion, a duty tax of about 6.0% of its value can be applied while the gold coins may attract a lower duty tax but depending on their country of origin and denomination.

Before embarking on the journey, first, consider conducting a thorough research on the duty taxes that may apply to your particular gold type and its value to be certain that you comply with the set Canada laws and regulations and also to avoid any unexpected charges.

What else should you consider when importing gold from Africa to Canada?

Supply Chain Transparency – ensure that you observe the ethical and responsible sourcing of your gold. The gold you intend to import should be verified and be sure it doesn’t have any connection to conflict, human rights abuses or any environmental harm.

Security –often there are security challenges importing gold from Africa to the Canada. This is why adequate security measures must be adhered to so as to protect it against theft or any other risks during transit.

In summary, importing gold into Canada is such a convenient alternative to any investor but what is significant is that you must adhere to the set regulations. Consider it a must-do to declare your gold to Canadian Customs and Border Protection.

Also, ensure that you conduct thorough research if any applicable duty taxes apply to ensure that you adhere to Canada Laws and Regulations. You wouldn’t want to wait till the last minute and be on a rush –get in touch with us.