1. Which African countries are the best to buy gold from?

Some of the top African countries where you can buy gold include:

- South Africa: One of the largest gold producers globally with a well-established market for buying and trading gold.

- Ghana: Africa’s second-largest gold producer, known for both large-scale and artisanal mining.

- Mali: Rich in gold reserves and one of the leading gold producers in West Africa.

- Tanzania: Known for its significant gold deposits and a growing gold mining industry.

- Zimbabwe: A country with a long history of gold mining, although political and economic conditions can influence the market.

2. How do I buy gold directly from African countries?

You can buy gold directly from African countries through:

- Gold mining companies: Many gold producers sell their gold to international buyers.

- Gold traders and dealers: Some traders specialize in sourcing and selling gold from African countries.

- Auction houses and wholesalers: Certain firms operate internationally and allow buyers to purchase gold in bulk.

- Artisanal miners: In some countries, local miners may sell directly to buyers, though this comes with risks regarding quality and authenticity.

3. Is it safe to buy gold from African countries?

Buying gold from African countries can be safe if you deal with reputable dealers or established mining companies. It’s important to verify the authenticity of the gold, ensure legal compliance, and work with certified traders to avoid fraud or counterfeit products.

4. What are the risks of buying gold from African countries?

Some of the risks include:

- Fraud and counterfeit: There’s a risk of buying fake gold if you’re not careful or working with trusted sources.

- Political instability: Some African countries experience political instability, which can affect gold markets.

- Illegal mining: Some gold may come from unregulated or illegal mining operations, raising ethical concerns.

- Shipping and customs: Importing gold can involve complicated regulations, taxes, and shipping risks, especially if you’re dealing with small or artisanal sellers.

5. What are the legal requirements for buying gold from Africa?

Each African country has its own legal requirements for buying and exporting gold. Common regulations include:

- Export permits: You may need an official permit to legally export gold out of the country.

- Taxation: Some countries may impose export taxes or fees on gold sales.

- Authentication: Ensure that the gold has been properly tested and certified for purity and weight.

- Compliance with international laws: It’s important to make sure the gold is not sourced from conflict zones or illegal mining operations.

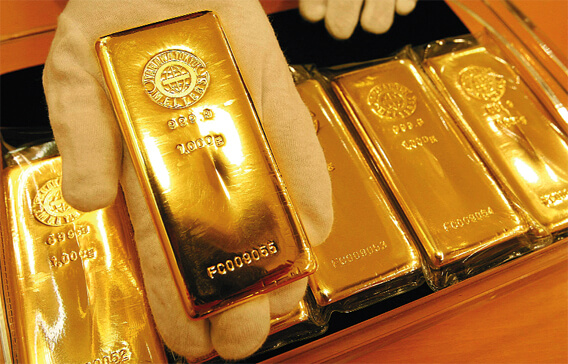

6. How do I ensure the gold I buy is genuine?

- Verification: Buy from certified gold dealers or reputable mining companies who offer certificates of authenticity.

- Testing: Physical tests like acid testing or using a gold tester can confirm the purity and authenticity.

- Documentation: Ensure all the relevant paperwork, such as export licenses or certificates of origin, accompanies your gold purchase.

7. Are there any import taxes or duties on buying African gold?

Yes, importing gold from African countries may be subject to taxes, customs duties, or import restrictions based on the country you are importing to. You should check with local customs authorities or consult with a customs broker to understand the exact fees involved.

8. What is the price of gold in African countries?

Gold prices in African countries are generally aligned with international market prices, but they can fluctuate based on local demand, currency exchange rates, and production costs. Keep in mind that prices may vary depending on the region, type of gold (e.g., refined vs. raw), and the seller.

9. Are there ethical concerns when buying gold from Africa?

Yes, ethical concerns include:

- Conflict gold: Some gold may be mined in conflict zones, where it may fund violence or exploitation.

- Child labor: Some artisanal mining operations use child labor, leading to human rights violations.

- Environmental damage: Unregulated mining practices can cause significant environmental harm, including deforestation and water contamination.

To ensure ethical sourcing, look for gold that is certified by organizations such as the Responsible Jewellery Council (RJC) or ensure the mining operations adhere to Fairmined standards.

10. Can I visit Africa to buy gold directly from miners?

Yes, you can visit African countries to buy gold directly from miners, particularly in regions with significant artisanal mining. However, this comes with risks, and you will need to ensure compliance with local laws, arrange for proper security, and be cautious about dealing with unverified sellers.

11. How do I import gold from Africa to my home country?

Importing gold typically requires:

- Licensing: Ensure you have the necessary export and import licenses.

- Customs clearance: Gold will need to pass through customs, and you may be required to pay taxes or fees.

- Documentation: Have the required documents, such as certificates of origin and proof of authenticity, to clear customs.

12. Is it legal to buy gold from African countries?

Yes, buying gold from African countries is legal as long as the transaction complies with both local and international laws. However, you need to ensure that the gold comes from legal and ethical sources, and you comply with all the necessary import/export regulations.

13. What is the best way to avoid scams when buying gold from Africa?

To avoid scams:

- Research the seller: Always verify the legitimacy of the seller, mining company, or dealer.

- Work with established companies: Deal with certified, well-known entities in the gold market.

- Request certifications: Ensure you receive certificates of authenticity and relevant permits for the gold you buy.

- Use a trusted intermediary: Consider using a trusted broker or third-party verification service to handle the transaction securely.

14. How can I get financing for buying gold from African countries?

Some financial institutions, such as banks and specialized investment firms, offer loans or financing for purchasing precious metals, including gold. Alternatively, you can work with local dealers or brokers who may provide payment plans or credit options.

15. How do I resell African gold if I buy it?

Reselling gold typically involves:

- Finding a reputable buyer: Look for trusted buyers or dealers who offer competitive prices for your gold.

- Certification and proof of authenticity: Ensure you have proper documentation to prove the gold’s authenticity and origin.

- Market fluctuations: Be aware of market conditions, as gold prices can fluctuate.