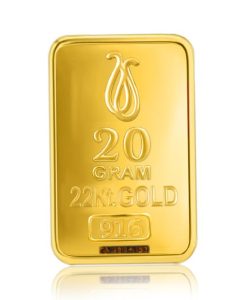

Buy 22k Gold Bars At A Cheap Price, 22 Karat Gold for Sale:

24k Gold Bullion Online – Investors seeking to enjoy the touch, feel and security of owning gold may wish to Buy 22k Gold Bars rather than intangible investment like gold exchange traded funds – ETFs. The physical/investment grade gold also popular as gold bullion can be bought at spot price, a price of unfabricated gold plus extra costs that often vary based on the seller.

Dealing with a licensed retailer online/wholesaler is one of the commonest ways to buy gold bars. By browsing online, you can come across our amazing gold bar products. When selecting the gold product to buy, consider the weight, quantity and price.

Buy 22k Gold Bars Online;

22k Gold bars are available for purchase from 1kg and depending on the seller; 32.15 oz gold can be bought at USD 63047.84 –spot price and buy price USD 64497.94. Talk to an Expert about Gold Price; +256 707 585144.

One kilo gold bars are investment-grade gold bullion bars weighing one kilogram that is 1000 grams. 1Kg of gold bars are believed to be the most purchased by both investors adding bullion to investment portfolios and also by the store of value buyers.

A kilo of gold bars have become the fast bought and attract high net worth and institutional investors in Asia and China.

One kilo gold bars are conveniently sized, and come at affordable prices. You can buy gold bars in US, Dubai, Singapore or any part of the world online with our team. You can also contact our team directly and make your order on phone. We do deliver gold bars and we ensure that all that we deliver is fully insured.

Payment for your products can be done by credit cards/debit card, bank wire and other forms. Before you make payment, make sure that you inquire from our team about the acceptable payment methods when buying gold online in Uganda with us.

22K GOLD VS 24K GOLD

Gold is with no doubt a sound investment asset in the world. The advantage with 22k gold is that it is durable making a superb investment opportunity compared to the 24k. However, 24k gold bars is far better than 22k when it comes to purity levels with 99.99% purity.

HOW MUCH IS GOLD IN UGANDA?

Do you want to Buy 22k Gold Bars, well Gold in Uganda varies in prices. The rates differ depending on the kilograms where gold rate per kilogram 22k costing shs. 217609159.58. If you plan to invest in gold business, first, keep up to date on the latest prices.

We provide up-to-date information about gold in Uganda and the latest prices to keep you informed. Gold rate/kilo 6k costs Uganda shs. 59261753.70.

The price of one kilo gold bar is calculated following the 3 components –the gold spot price that is the price of 1 troy oz of pure gold which is available for immediate delivery.

The second component is the weight of gold, where a kilo of gold bar weighs .999/.9999 parts of pure gild. 1 kilo ounce gold bar weighs a bit higher than 32.1507 troy ounces in weight when impurities are accounted for.

The last determining factor is the gold price premium –the percentage adjustment which is added/deducted from the gold spot price value of the gold bar. The gold premium often determines the production costs, minting, refining, logistics and fabrications, etc.

OTHER GOLD BULLION PRODUCTS TO CONSIDER BUYING;

Often investors consider buying 1 kilo gold bars to secure lower gold prices per unit. The gold bars are kept in a safe storage and rarely take delivery. They also purchase gold bars ranging 1 oz to 10 oz, and these serve as alternatives to purchasing kilo gold bars.

You can also opt for long term basis and encourage our clients to consider mixt of gold bar formats when buying since they allow for most eventualities and on average, attract lower premiums.

Buy 22k Gold Bars Today!

Frequently asked questions (FAQs) about 22K gold bars:

1. What is 22K gold?

22K gold refers to gold that is 91.67% pure, with the remaining 8.33% made up of other metals such as copper, silver, or zinc. The “K” stands for karat, which is a unit used to measure the purity of gold. 22K gold is commonly used for making jewelry and some gold bars, and is considered high quality but not as pure as 24K gold, which is 99.9% pure.

2. Why choose 22K gold bars?

22K gold bars are chosen for their balance between purity and durability. While 24K gold is more pure, it is softer and more prone to damage. 22K gold bars have a slightly lower purity, but they are more durable and are often less expensive than 24K gold, making them an attractive option for investment and jewelry.

3. How does 22K gold compare to 24K gold?

The primary difference between 22K and 24K gold is purity. 24K gold is considered 99.9% pure and is the highest grade of gold available. However, because it is softer, it can be more easily scratched and bent. On the other hand, 22K gold, with a purity of 91.67%, is slightly harder and more durable, making it better for bars that need to withstand handling or transportation.

4. What is the price of 22K gold bars?

The price of 22K gold bars depends on the current market price of gold (the spot price), the weight of the bar, and any dealer premiums or taxes. Since 22K gold is less pure than 24K gold, it typically costs less. Prices can fluctuate based on factors like market demand, the global economy, and geopolitical events. You can find the current price of 22K gold bars by checking online dealers or gold trading platforms.

5. Can I invest in 22K gold bars?

Yes, 22K gold bars are a popular investment option. They are often used by investors who want to hold physical gold in a form that is more affordable and durable than 24K gold. However, it’s important to remember that while 22K gold bars are a relatively good investment, they may not offer the same potential for resale value as higher-purity gold. Always ensure you buy from a reputable dealer.

6. Are 22K gold bars accepted internationally?

Yes, 22K gold bars are generally accepted internationally, although the preference for purity can vary from region to region. In markets like India and the Middle East, 22K gold is highly preferred for both investment and jewelry. In Western markets, 24K gold bars may be more common for investment purposes, but 22K gold is still widely recognized and accepted.

7. How do I verify the authenticity of a 22K gold bar?

To verify the authenticity of a 22K gold bar, you should look for the following:

- Certificate of Authenticity: Reputable dealers will provide a certificate of authenticity that confirms the purity and weight of the gold.

- Hallmark or Stamp: A genuine 22K gold bar will have a hallmark or stamp indicating its purity (91.67% or 22K) and the manufacturer’s logo or name.

- Acid Testing or X-ray Fluorescence (XRF): You can have the gold tested using these methods to confirm its purity, although it’s typically best to buy from a trusted dealer to avoid the need for testing.

8. How should I store my 22K gold bars?

Storing 22K gold bars securely is crucial to avoid theft, loss, or damage. Some options for storing gold include:

- Safety Deposit Box: Many banks offer safety deposit boxes where you can store gold securely.

- Private Vaults: There are specialized private vaults that provide high-security storage for valuable items like gold.

- Home Safe: For smaller amounts of gold, a high-quality home safe with good security features can be an option.

- Insured Storage: Some dealers offer insured storage solutions for your gold bars, which may be worth considering for peace of mind.

9. Is 22K gold suitable for making jewelry?

Yes, 22K gold is commonly used in jewelry making, especially in regions where 22K is the standard, such as in parts of Asia and the Middle East. It has a rich yellow color and high value due to its purity, although it is softer than 18K or 14K gold and may not be as durable for items subjected to heavy wear, such as rings or bracelets. To increase durability, 22K gold jewelry may be alloyed with small amounts of other metals.

10. What are the risks of investing in 22K gold bars?

While investing in 22K gold bars is generally considered safe, there are a few risks to consider:

- Price Volatility: The price of gold can fluctuate due to global economic factors, which could affect the value of your gold investment.

- Counterfeiting: If you buy from untrustworthy sources, you risk receiving counterfeit or impure gold. Always buy from reputable dealers.

- Liquidity: It may be harder to sell 22K gold bars compared to 24K gold bars, especially in markets where 24K is preferred. The resale value could be lower due to the lower purity.

11. Can I sell 22K gold bars easily?

Yes, you can sell 22K gold bars, but the ease of selling depends on the market. In regions where 22K gold is popular (such as India or the Middle East), selling 22K gold bars can be relatively easy. In Western countries, 24K gold may be preferred for investment purposes, but many dealers and gold buyers will still accept 22K gold at a slightly discounted price based on its purity.

12. What is the weight range for 22K gold bars?

22K gold bars are available in a variety of sizes, ranging from small 1-gram bars to larger bars weighing 10 ounces (about 311 grams) or even 1 kilogram (32.15 ounces). The size of the bar you choose will affect the price and premium over the spot price, with smaller bars often having higher premiums per gram or ounce compared to larger bars.

13. Are there any taxes when buying 22K gold bars?

The tax treatment of 22K gold bars depends on the country in which you buy them. In some countries, gold purchases may be subject to VAT (Value Added Tax) or sales tax, while others, like Singapore, have no tax on gold bars (if they are of 99.5% purity or higher). Always check the tax regulations in your country before purchasing.

14. Can I convert my 22K gold bar into a different form of gold?

Yes, you can convert your 22K gold bar into other forms of gold, such as coins, jewelry, or even a 24K gold bar. However, the conversion process may incur additional fees or loss in weight due to melting, re-refining, or manufacturing costs. It’s best to work with a reputable gold dealer or refiner to ensure a fair conversion process.

You may also like;