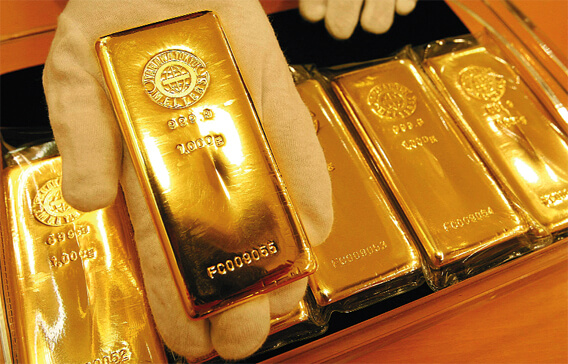

Buy Gold Bars in USA Online from Trusted Africa Gold Dealers

Planning to Buy Gold Bars in USA Online? Well, here is the Best place to buy gold bars online with secure shipping & affordable prices on gold bullion bars.

Traveling long distances to buy gold from Africa or any part of the world can be stressing and time consuming.

With online option, anyone planning to invest in gold can now have his or her product secured at ease by simply following the steps provided. Buying gold bars online in USA is now easier than before with your trusted gold dealers.

Buying gold online in USA with us guarantees you a great chance to add gold bars to your investment portfolios and in return, you diversify the risk and at the same time, you can be safeguarding your wealth.

All gold bars in Uganda purchased from us are investment grade bullion bars from approved/recognized refineries.

Read: Tips for Buying Gold Online.

We understand the need of every client to have something unique, a great reason we work tireless to avail you the best. We are solution providers to all clients’ needs when it comes to gold investment.

WHY & WHERE TO BUY GOLD BARS?

Every year, we serve 1000s of clients and the amazing part is that we have one of the latest and secure online trading platforms. We are capable of providing gold bars of varying sizes right from 1 oz to 400 oz.

We can even provide high-security alternatives and we do this to ensure that our customers’ investment wealth is safe and secured.

During storage, safety, privacy, confidentiality and security come to play, a reason thousands of gold investors have trusted us for a test of time. These and more plus over 7000 customers, and multi million transactions, we can confidently say that we are your first choice when it comes to gold investment/business.

You may also like to; Buy gold from Congo,

WHAT ARE GOLD BARS?

Gold bars are uniform slab of gold and have up to 99.9 percent purity. Gold bars exist in different weights and sizes thus meeting the needs of all investors. The Gold bars are often provided by private refineries and sovereign mints.

The huge gold bars are minted by pouring molten gold into a mould and the tiny bars are cast using heavy machinery. It should be noted that gold bars are bought for different uses including commercial finance instruments, personal assets and serve as reserve currency.

Most people currently make best use of it as a long term store of value and as a proven hedge against inflation or uncertainty. Talk to an expert today; +256 707 585144.

Full Definition of Gold Bars.

HOW MUCH ARE GOLD BARS IN USA?

Gold bar prices vary from one company to another and it is always advisable to cross-check for the latest rates. However, 1 (one) ounce of gold bullion bar can go for US 65,000.

INVESTING IN GOLD BARS AND WHAT YOU NEED TO KNOW.

If you plan to invest in gold bars, there are many factors to be put into consideration to ensure that you make the right decision. They include ensuring that you are buying pure gold bars. The purity of gold bars matters a lot for anyone with plans to engage in gold investment.

Divisibility –gold bars usually come in even shape, rectangular blocks and contain 99.99 percent (%) gold content. The bar sizes and weights differ, but most common sizes are 1 oz, 10 oz gold bars to 400 oz.

Storage – if you are dealing in small quantities, then you can easily them safe back at home. Larger investment requires you to use specialized insured vaults in secure jurisdictions run by experts. Bottom of Form.

People also like to; Buy Gold in the UK.

Buy Gold Bars in USA Online Today!

Frequently asked questions about gold in the USA:

1. Where can I buy gold in the USA?

You can buy gold from reputable sources such as banks, authorized dealers, online platforms, and local coin shops. Some popular online gold retailers include JM Bullion, APMEX, and Kitco.

2. What is the current price of gold in the USA?

The gold price fluctuates daily based on global market conditions. You can check live gold prices on financial news websites, the COMEX exchange, or through gold dealer websites.

3. Is buying gold a good investment in the USA?

Yes, gold is considered a safe-haven investment that can hedge against inflation, currency fluctuations, and economic instability. However, like any investment, it carries risks and should be part of a diversified portfolio.

4. How can I ensure the gold I buy is authentic?

To ensure authenticity, purchase from reputable dealers, request assay certificates, check for hallmarking, and consider third-party verification from certified appraisers.

5. Do I need to pay taxes when buying gold in the USA?

Sales tax on gold purchases varies by state. Some states, like Alaska and Delaware, have no sales tax on gold, while others impose taxes based on the purchase amount and form of gold.

6. What types of gold can I buy in the USA?

The most common types include gold coins (e.g., American Gold Eagle), gold bars, gold jewelry, and gold bullion. Coins and bars are often preferred for investment purposes.

7. Can I sell my gold easily in the USA?

Yes, you can sell gold to jewelry stores, pawn shops, gold dealers, and online platforms. Be sure to compare prices and verify the buyer’s credibility before selling.

8. What factors affect gold prices in the USA?

Gold prices are influenced by factors such as inflation rates, interest rates, geopolitical events, currency values, and central bank policies.

9. How much is 1 ounce of gold worth in the USA?

As of today, the price of 1 ounce of gold fluctuates around $1,900 – $2,100 USD, depending on market conditions. Always check real-time rates before making a purchase.

10. What is the best way to store gold in the USA?

Gold can be stored in a bank safe deposit box, a private vault, or a home safe. Insuring your gold is also recommended for added security.

11. Can I import gold into the USA?

Yes, but you must comply with customs regulations, declare the gold upon entry, and pay any applicable duties or taxes.

12. Is gold subject to capital gains tax in the USA?

Yes, if you sell gold for a profit, it may be subject to capital gains tax, typically classified as a collectible with a tax rate of up to 28%.

13. What is the difference between 24K and 22K gold?

24K gold is 99.99% pure, while 22K gold contains 91.67% gold mixed with other metals like copper and silver to increase durability.

14. Can I use gold as collateral for a loan in the USA?

Yes, many financial institutions and pawn shops accept gold as collateral for secured loans based on its current market value.

15. Are gold ETFs a good investment alternative to physical gold?

Yes, gold ETFs provide exposure to gold prices without the need to store physical gold. They are traded on stock exchanges and offer liquidity and convenience.

You also like to;