Buy Gold Bars Online Singapore – Buy 24k Gold Bars Singapore

Gold Bars For Sale Singapore; Are planning to buy gold bars online Singapore or investing in gold but not sure how you can get it? Whether you are in Singapore or other Asian country, buying gold from Africa online has become simpler than ever before.

With our varied options of gold investments, buying gold online is without doubt the easiest way.

Our gold investment bar options are available worldwide. Purchasing gold bars in Singapore or anywhere else has proven to be the most affordable option for anyone interested in investing in gold business.

We have our gold bars available in different parts of the world in varying weights and types ranging from minted to cast gold bars.

What is interesting is that all our gold products are of highest quality. We sell the highest invest grade gold bullions/bars. We provide fully insured delivery globally. Our gold bars are extremely pure guaranteeing you the right investment.

HOW TO BUY GOLD BAR ONLINE IN SINGAPORE?

Buy gold bars in Singapore at a great value. Here are available options to buy gold bars online in Singapore;

BUY GOLD BULLION SINGAPORE;

For the past 1000 years, gold has been used for different purposes such as money and as long term store of value. Buying gold guarantees you the most stable assets. It is a traditional safe haven for investors and best way to diversify your portfolio.

The prices usually move independent of stocks and financial markets meaning when the stock market falls in value, gold usually rises. There are few assets that are completely free of counterparty risk, and historically, physical gold and silver have had a long purchasing power in the market.

You may like; Tips for Buying Gold Online.

GOLD COINS;

You can purchase gold coins in Singapore and these are often produced by government mints and different from gold rounds given their face value. The face value of gold can be used as legal tender in the country of issue.

The gold coins hold a bit a higher premium than gold bars considering the extra fabrication costs involved in production. If the gold price increases, the price of gold coins also increase. It is possible to buy pure gold coins in different sizes of 1 gram to 1kg.

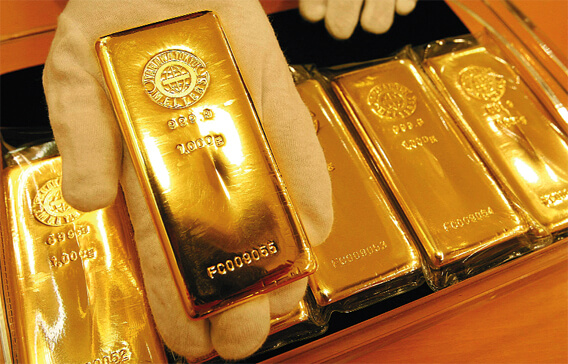

GOLD BARS;

Gold bars are available for purchase online. The beauty of gold bars is that they are produced by recognized private mints or government mints. They are usually available in varying sizes of 1 gram to 400 oz –also considered to be London good delivery bar.

The gold bars often feature serial numbers and tamper-proof certicard containing assay information, signature of the chief assayer plus a serial number similar to the number stamped on the bar.

Serial numbers play a great part, especially if the gold bars are being allocated or held in a trust or segregated storage. You can order your gold bars online with us, a time and money saving option to secure your gold.

GOLD ROUNDS;

An investor can also purchase gold rounds and these are mainly produced by private mints. The gold rounds have craftsmanship and don’t carry a face value. The gold rounds are usually available for purchase in varying sizes of 1 to 10 oz and more.

Buy Gold Bars in Singapore Today!

Frequently asked questions (FAQs) about buying, selling, and investing in gold in Singapore:

1. What is the current gold price in Singapore?

The price of gold in Singapore typically follows the global spot price, but it can vary slightly due to local market conditions, dealer premiums, and the type of gold being purchased (e.g., gold bars, coins, or jewelry). You can check real-time gold prices on websites like GoldPrice.org, Kitco, or local gold dealers in Singapore.

2. Is buying gold in Singapore a good investment?

Yes, gold is generally considered a safe-haven investment, especially during times of economic uncertainty. Singapore is a key global financial hub with a stable economy, which makes it an attractive place to invest in gold. Many investors buy gold as a hedge against inflation or currency devaluation. Additionally, Singapore has no capital gains tax on gold investments, which can be a key benefit for investors.

3. What types of gold can I buy in Singapore?

In Singapore, you can purchase various forms of gold, including:

Gold Bars: These are available in different weights and are often the most cost-effective form of gold investment.

Gold Coins: Popular coins include the Singapore Mint coins, Gold Kangaroo Coins from Australia, and Gold Maple Leaf Coins from Canada.

Gold Jewelry: Gold is also widely sold in jewelry stores throughout Singapore.

Gold ETFs (Exchange-Traded Funds): Investors can also invest in gold through ETFs that track the price of gold.

4. Do I need to pay GST (Goods and Services Tax) on gold in Singapore?

Gold bars and coins that are of 99.5% purity or higher are exempt from GST in Singapore. This makes buying gold in Singapore more cost-effective compared to countries that impose VAT or GST on gold purchases. However, gold jewelry is subject to GST in Singapore.

5. How do I buy gold in Singapore?

You can buy gold in Singapore through various channels:

Authorized Dealers: Many trusted dealers and banks offer gold bars and coins for purchase.

Gold Shops and Jewelry Stores: There are numerous stores where you can buy gold jewelry or small gold bars.

Online Platforms: Online trading platforms also allow you to buy physical gold or invest in gold ETFs.

Banks: Some banks in Singapore offer gold investment products, including gold savings accounts and gold-related financial instruments.

6. How can I sell gold in Singapore?

Selling gold in Singapore is relatively straightforward. You can sell gold at:

Gold Dealers: Authorized dealers will buy back gold bars, coins, or jewelry at current market prices.

Pawn Shops: Some pawn shops in Singapore may buy gold, but they often offer lower prices compared to dealers.

Jewelry Stores: Certain jewelry stores will buy back gold jewelry, although they may offer a lower price than gold dealers.

7. How do I store my gold securely in Singapore?

Gold should be stored securely to protect it from theft or damage. In Singapore, you can choose to store your gold in:

Bank Safety Deposit Boxes: Many banks offer safety deposit boxes where you can store your gold in a secure, insured facility.

Private Vaults: There are also private vaults in Singapore that provide highly secure storage for gold.

Home Safes: If you prefer to store your gold at home, you can purchase a high-security safe.

8. Is it safe to buy gold online in Singapore?

Yes, buying gold online in Singapore is safe, as long as you use reputable platforms and authorized dealers. It’s important to ensure that the website is trustworthy, offers transparent pricing, and provides a certificate of authenticity for the gold. Look for platforms with positive reviews and strong security features.

9. What is the minimum amount of gold I can buy in Singapore?

In Singapore, you can buy gold in small amounts, such as 1-gram or 5-gram gold bars, making it accessible for small investors. Larger bars, such as 1 kg or 10 oz, are also available for those looking to invest a larger sum of money. The minimum purchase size will depend on the dealer or platform you choose.

10. Can I invest in gold without physically owning it?

Yes, you can invest in gold without physically owning it through financial products like:

Gold ETFs (Exchange-Traded Funds): These allow you to invest in gold without holding physical gold.

Gold Futures Contracts: For more experienced investors, gold futures can be used to speculate on the price of gold.

Gold Certificates: Some financial institutions offer gold certificates as a way to invest in gold.

11. Is there a tax on selling gold in Singapore?

There is no capital gains tax on gold in Singapore, meaning that if you sell gold at a profit, you will not have to pay any tax on the gain. This is one of the reasons why Singapore is a popular location for gold investment. However, if you are selling gold jewelry, you may be subject to GST, depending on the type and purity of the gold.

12. What are the risks of investing in gold?

While gold is considered a relatively safe investment, there are still some risks, including:

Market Fluctuations: The price of gold can be volatile, influenced by factors like global economic conditions, inflation, and currency fluctuations.

Storage Costs: If you are holding physical gold, there are costs associated with securing and storing it.

Liquidity: It may take time to find a buyer, especially for large amounts of gold.

13. How do I verify the authenticity of gold in Singapore?

To verify the authenticity of gold in Singapore, you should look for the following:

Certificate of Authenticity: Ensure the dealer provides a certificate of authenticity, which should include details about the purity and weight of the gold.

Hallmark: Gold bars and coins are typically stamped with a hallmark that indicates their weight, purity, and the mint or manufacturer.

Reputable Dealers: Always buy gold from authorized and reputable dealers to avoid counterfeit gold.

14. Can I buy gold in Singapore as part of a retirement savings plan?

Yes, you can buy gold in Singapore as part of your retirement plan through investment vehicles like Gold ETFs or Gold Savings Accounts. These options allow you to invest in gold while potentially benefiting from the long-term price appreciation of gold. Make sure to consult a financial advisor to determine the best investment strategy for your retirement needs.

You may also like;