Gold ETFs; List of Best Gold ETF & Demerit of ETF Investment

What is a Gold ETF?

A Gold ETF is a type of exchange-traded fund that invests primarily in gold. Its major aim is to track the price of gold on the global market by holding physical gold bullion or gold futures contracts.

Gold ETFs are the perfect choice, a convenient and liquid way for investors who wish to get exposure to gold without the need to manage physical gold bullion bars or coins.

These ETFs are traded on stock exchanges, making them accessible to potential investors through brokerage accounts just like individual stocks.

List of Gold ETFs

| Gold ETF | ONE YEAR RETURN |

| UTI Gold ETF | 10.7% |

| Invesco India Gold ETF | 10.1% |

| ICICI Prudential Gold ETF | 9.7% |

| Axis Gold ETF | 10.6% |

| Aditya Birla Sun Life Gold ETF | 9.6% |

| Kotak Gold ETF | 11.4% |

| Nippon India Gold ETF | 9.5% |

| Quantum Gold ETF | 9.5% |

| SBI Gold ETF | 9.5% |

The Best Gold ETFs to Buy

When considering investing in Gold ETFs, it’s crucial to understand and evaluate different ETF options based on various factors such as expense ratios, liquidity, and tracking accuracy. Some of the best Gold ETFs to consider include:

SPDR Gold Shares (GLD): This is one of the largest and most known on the gold ETF market. It holds physical gold with the major aim being to reflect its price. It can easily be traded making it a popular choice among gold investors.

iShares Gold Trust (IAU): Just like GLD, iShares Gold Trust holds physical gold bullion with the intent to display its price. This is known for its lower expenses compared to GLD and other different competitors. This makes it an attractive choice for budget gold investors.

VanEck Vectors Gold Miners ETF (GDX): Unlike GLD and IAU, GDX does not hold physical gold but rather invests in shares of different gold mining companies. This offers investors leveraged exposure to the gold market and may offer higher returns and on the other with higher risks.

Aberdeen Standard Physical Gold Shares ETF (SGOL): This ETF is known for its emphasis on transparency and secure storage of physical gold, which is kept in Switzerland. SGOL is another viable option for investors seeking physical gold exposure.

Is Gold ETF a Good Investment?

Gold ETFs tend to be a good investment, particularly for those looking to hedge against inflation. They offer several advantages and among these include:

Gold ETFs carry a high liquidity level and hence are conveniently traded on major stock exchange markets, allowing investors to buy and sell shares easily in case they need immediate cash.

Gold ETFs are highly cost-effective investment options compared to buying physical gold. They come with lower transaction costs, and no storage fees, though they do have management fees.

For investors looking to diversify their portfolios, Gold ETFs provide a straightforward way to add gold exposure without having to face the complexities that come with handling physical gold.

However, the suitability of Gold ETFs as an investment depends on individual financial goals and market conditions. They may not provide the same level of tangible value as owning physical gold, and their performance is subject to fluctuations in the gold market and broader economic factors.

What is the Minimum Investment in Gold ETFs

The minimum investment required to buy Gold ETFs generally depends on the price of the ETF share and the brokerage platform you have chosen to use. For instance, if a Gold ETF is trading at $150 per share, purchasing one share would require an investment of at least $150 not forgetting to add the brokerage fees that will come with it.

Some Gold ETF brokers offer fractional shares offering investors an opportunity to purchase any chare of their choice depending on their financial needs. These offers make Gold ETFs flexible and hence more accessible to a wide range of investors.

Disadvantages of investing in Gold ETFs

While Gold ETFs offer many benefits, they also come with certain disadvantages:

No Physical Ownership: With gold ETFs, you typically do not have physical ownership of gold. Rather you own shares that represent gold. This may not be suitable for people who prefer holding physical gold hence discouraging them from investing in gold.

Expense Ratios: Although offered at relatively low rates compared to buying physical gold or other investments, Gold ETFs still come with management fees which can accumulate over time affecting investment returns most especially if the ETF performance has not met the expectations.

Market Risk: just like Physical gold, gold ETFs are as well affected by different conditions like gold price fluctuations, and the overall economic stability. This comes with a potential level of market that investors are required to beware of.

Counterparty Risk: For Gold ETFs that invest in futures contracts or other financial instruments rather than physical gold, there is an element of counterparty risk. This refers to the risk that the financial institutions involved may fail to meet their obligations.

Tax Considerations: The tax treatment of gains from Gold ETFs can be different from that of physical gold investments, potentially leading to less favorable tax outcomes depending on one’s jurisdiction.

How to Invest in Gold ETFs

By following these steps, you can efficiently invest in Gold ETFs, gaining exposure to gold while enjoying the ease of trading on financial markets.

Research and Choose a Gold ETF: Start by researching various Gold ETFs to find one that fits your investment goals. Popular options include SPDR Gold Shares (GLD) and iShares Gold Trust (IAU), which hold physical gold bullion. Consider factors like the ETF’s expense ratio, liquidity, and how closely it tracks the price of gold.

Open a Brokerage Account: To invest in Gold ETFs, you need a brokerage account. Choose a reputable brokerage firm that offers access to ETFs. Many online brokers allow you to open an account with minimal initial deposits and provide tools to research and trade ETFs.

Deposit Funds: Once your brokerage account is set up, deposit funds into the account. You can transfer money from your bank account or other investment accounts. Make sure you have sufficient funds to cover the cost of the ETF shares you wish to purchase, including any transaction fees.

Place Your Order: Log into your brokerage account, search for the Gold ETF you’ve selected, and place an order. You can choose to buy a set number of shares or invest a specific dollar amount. Use market or limit orders based on your preference.

Monitor Your Investment: After purchasing, keep an eye on your Gold ETF investment. Track its performance, review any changes in the gold market, and adjust your investment strategy as needed.

Gold ETF RETURNS

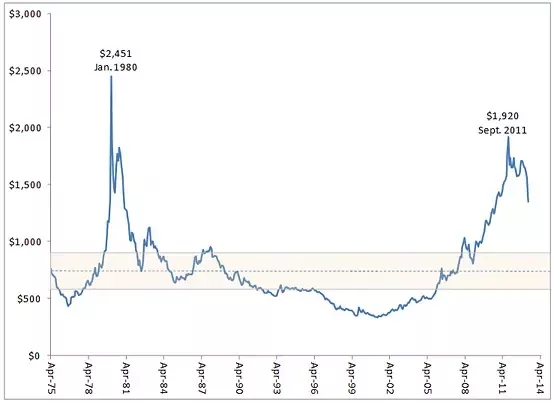

Gold ETFs aim to mirror the performance of gold, providing investors with returns linked to the price movements of the precious metal. Their returns depend largely on the underlying gold price, which can fluctuate based on factors such as economic conditions, inflation rates, and geopolitical events.

Gold ETFs that hold physical gold bullion, like SPDR Gold Shares (GLD) and iShares Gold Trust (IAU), typically offer returns that closely track the spot price of gold. Their performance is reflected in the daily changes in gold prices. For instance, if gold prices rise, the value of the ETF increases proportionally, and vice versa.

On the other hand, Gold ETFs that invest in gold mining companies, such as VanEck Vectors Gold Miners ETF (GDX), can exhibit higher volatility. Their returns are influenced not only by gold prices but also by the operational performance and stock market movements of the mining companies.

Overall, while Gold ETFs provide an effective way to gain exposure to gold, they are subject to market risks and price volatility. Investors should consider these factors and their investment goals when evaluating potential returns.