How to Buy Gold in Uganda? Tips and Best Gold Types to Buy:

Checkout our guide on how to buy gold in Uganda. Get expert tips on navigating the market, understanding legal requirements, and identifying the best types of gold to invest in.

Gold business still stands out as one of the most desired ventures for most investors around the globe and to most people, gold is undoubtedly an asset that provides a sense of security.

Like other businesses, dealing in gold is a risky venture as well and prior committing yourself, first there are key areas you must understand. These include how you intend to buy your gold in Uganda or any country around the world.

For starters intending to engage in diversifying their investment portfolio, there are basics that you must get to know. This is why we have come up with this comprehensive guide to assist you do things right in the world of gold investment.

How to buy gold in Uganda?

Where to Buy Gold in Uganda

Gold bullion dealers;

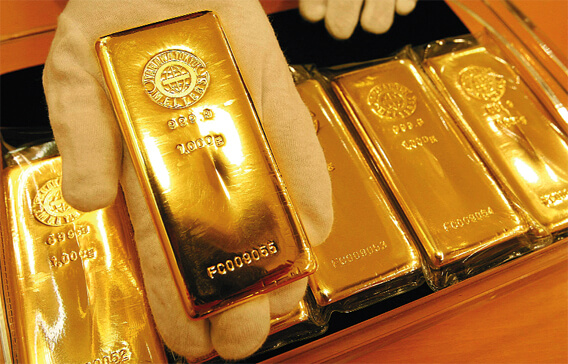

Bullion is a form of physical gold of high purity and often comes in different forms including bars, coins, rounds, and ingots.

Rounds are usually mistaken as coins considering their circular shape although they are closer to gold bars because they do not have value as legal tender and also their design doesn’t differ from one year to the next. Gold bars come in varying sizes from 1 gram to 400 ounces.

In terms of pricing, the bullion dealers often base on the real-time market value of gold and a small premium to cater for the cost the dealer incurs and profits.

To be on the safer side, you must deal with a reliable or reputable dealer, legally accredited company that deals in the gold trade in Uganda and beyond. You can buy gold in Uganda from us via online or visit our physical stores.

Online Platforms;

The quickest way to buy gold in Uganda is by dealing with us via our online platforms. We have active website with a modernized process to guide you on how you can conveniently purchase your gold. Visit our website now and within a few clicks, you get the right information and assistance from the expert.

The beauty of our online platforms is that you get to know how we safely store our physical gold. Connect with us at +256 707 585144 or email us via nelsonamadou12@gmail.com.

Jewellery stores;

You can buy wearable gold from our available stores. This comes in the form of necklaces, rings, and bracelets.

Gold ETFs –(Exchange –Traded Funds) & Mutual funds;

An investor can also directly invest in one of the gold-based exchange-traded funds. Every share you get from ETFs represents a fixed amount of gold like one-tenth of an ounce.

ETFs can be bought or sold like stocks in any brokerage account/individual retirement account –IRA. It is notably the easiest and most cost-effective criterion compared to owning gold bars/coins directly and is preferable for small investors.

The mutual funds come with several benefits including low cost and low minimum investment, ease of ownership in a brokerage account, you do not need individual company research and in terms of diversification, there is a range of gold-related assets thus presenting you plenty of gold markets.

In summary, investing in gold comes with plenty of benefits, especially if you are looking for long-term gains. With the guide above, you can be in a position to navigate through the gold business at ease whether you are a new or seasoned investor.

Legal Requirements to Buy Gold in Uganda

When buying gold in Uganda, there are several legal requirements to ensure a legitimate transaction:

-

Licensing and Regulation: Only licensed dealers or businesses can legally sell gold in Uganda. Ensure the gold dealer has the necessary business license issued by the Uganda Revenue Authority (URA) or the Uganda Chamber of Mines and Petroleum. Buying from an unlicensed source could result in legal complications.

-

Taxation and Duties: Gold transactions are subject to taxation. Value-added tax (VAT) is applicable on gold purchases, and customs duties may apply if importing gold into Uganda. Ensure that taxes are paid, and keep receipts for documentation. Buyers may also be required to pay a stamp duty on the purchase of high-value gold.

-

Import and Export Regulations: If you’re purchasing gold from international dealers or intend to export gold from Uganda, declaration to customs is mandatory. You must comply with customs regulations, which may include providing proof of the source and authenticity of the gold.

-

Gold Purity and Certification: Gold sold in Uganda must meet certain purity standards. Dealers must provide certificates of authenticity or assay reports verifying the purity and weight of the gold being sold.

Following these legal requirements will help ensure a smooth and lawful gold-buying process in Uganda.